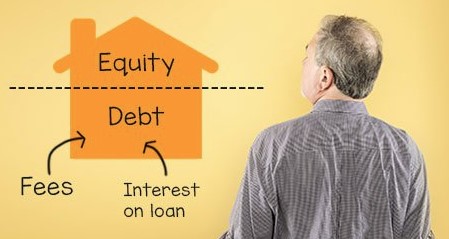

The Consumer Financial Protection Bureau released a new guide for older homeowners called You have a reverse mortgage: Know your rights and responsibilities. The new guide is the latest tool in the CFPB’s suite of reverse mortgage resources, which provides easy-to-understand information for prospective and current reverse mortgage borrowers.

The guide is designed to assist reverse mortgage borrowers meet their ongoing responsibilities under a Home Equity Conversion Mortgage, the most common type of reverse mortgage loan.

Topics include:

- The reverse mortgage loan requirements

- How a borrower may pay-off their reverse mortgage loan

- What happens after the borrower moves out of the home or dies

- What default means and how a borrower may find help

- What heirs may need to know

The guide also includes a glossary of commonly used terms and a list of resources that borrowers can use to find help.

The CFPB’s reverse mortgage resources are free and available to download or order.

For more information on reverse mortgages, visit consumerfinance.gov/reversemortgage.