The 2025 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting … more Retirement Savings “Magic Number” Drops to $1.26M

Industry News & Reference

HUD Introduces FHA Catalyst Partner Environment

This week, the Federal Housing Administration announced in FHA Info 2025-19 the availability of the Catalyst Partner Environment, a new Application Programming Interface (API) testing platform designed to … more HUD Introduces FHA Catalyst Partner Environment

Debt’s Impact on Older Americans

A new survey of Gen X and Baby Boomer Americans conducted by National Debt Relief reveals how soaring costs and debt burdens are delaying retirement and reshaping financial … more Debt’s Impact on Older Americans

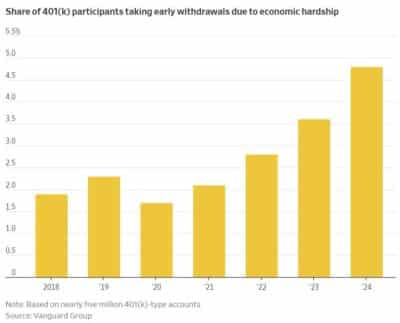

U.S. Workers Tapping Retirement Accounts At Increasing Rates

While 401(k) balances are growing, an increasing number of retirement savers are using their retirement accounts for financial emergencies. A new survey published by the Transamerica Center for … more U.S. Workers Tapping Retirement Accounts At Increasing Rates

FHA Rescinds Anti-Discrimination Appraisal Policies

The Federal Housing Administration rescinded three mortgagee letters that had sought to reduce discrimination in the appraisal process but which the Trump administration argued had created barriers and … more FHA Rescinds Anti-Discrimination Appraisal Policies

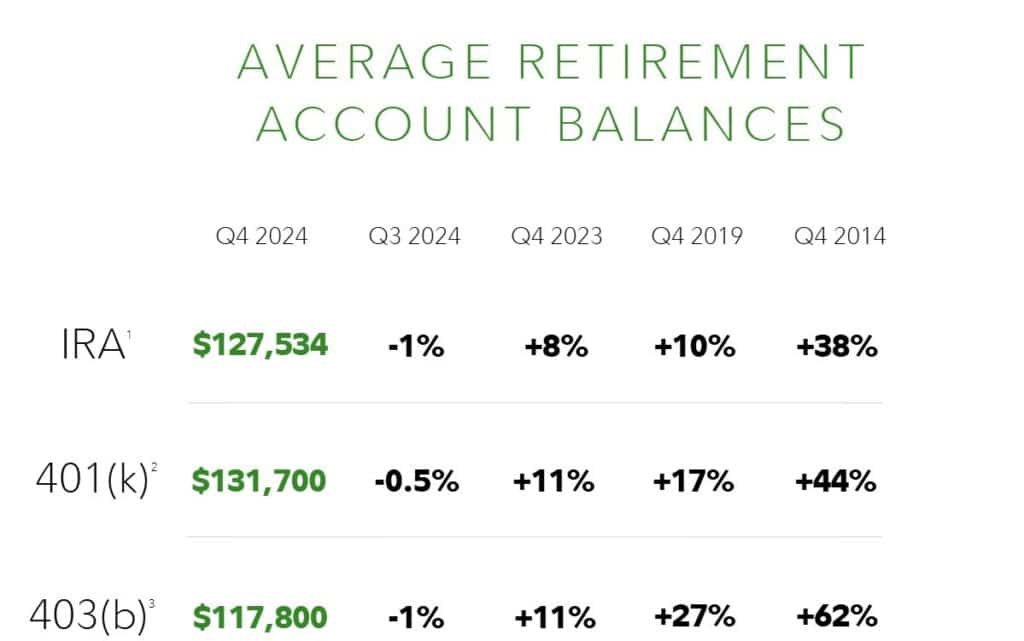

Fidelity: Retirement Account Balances Increase Year-Over-Year

Fidelity Investments’ latest Q4 2024 retirement analysis shows that retirement savers experienced a year of growth in 2024. While retirement account balances dipped slightly from Q3 2024, the average 401(k) … more Fidelity: Retirement Account Balances Increase Year-Over-Year

NRMLA Seeks Revision to WA State Legislation

NRMLA submitted a letter to lawmakers requesting a revision to Senate Bill 5686, so that it more closely matches Washington’s reverse mortgage laws. Dig Deeper: SB 5686 would, … more NRMLA Seeks Revision to WA State Legislation

NRMLA Asks HUD to Extend ORCA Initiative to HECM

NRMLA has asked the Department of Housing and Urban Development to consider extending its Optional Reimbursement Claim Alternative (ORCA) to the HECM program. Earlier this year, HUD published … more NRMLA Asks HUD to Extend ORCA Initiative to HECM

HUD Extends Foreclosure Relief to CA Homeowners

The Department of Housing and Urban Development announced a 90-day extension of its foreclosure moratorium on FHA-insured mortgages, including HECMs, for areas of Los Angeles County devastated by … more HUD Extends Foreclosure Relief to CA Homeowners

NRMLA Submits Letter Opposing MD Senate Bill 831

Why it matters: Maryland SB 831, as drafted, requires reverse mortgage lenders to establish escrow accounts so that loan proceeds can be used to pay for property taxes, … more NRMLA Submits Letter Opposing MD Senate Bill 831