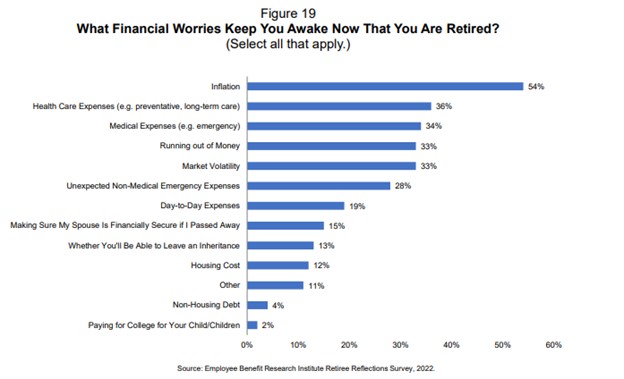

More than two-thirds (70%) of American retirees wished they had saved more and planned earlier for retirement, according to the 2022 Retiree Reflections Survey, published recently by the … more Survey: 70% of Retirees Have This Regret

Industry News & Reference

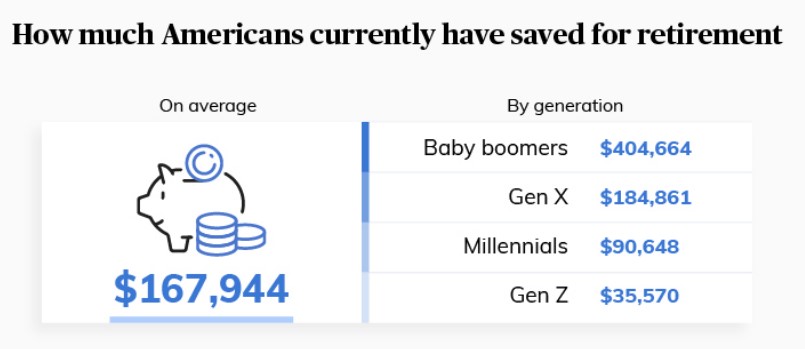

Average US Retirement Savings Is $168K, Survey Says

A recent survey of 1,000 Americans conducted by ConsumerAffairs found that the average amount saved for retirement across all age groups was $167,944, while Baby Boomers had the … more Average US Retirement Savings Is $168K, Survey Says

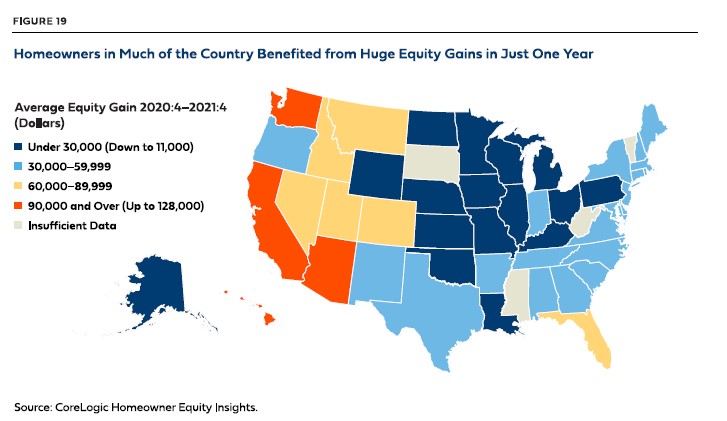

Report: Aggregate Home Equity Exceeds Record $26 Trillion

Housing wealth has increased 39 consecutive quarters, increasing from $10.1 trillion in early 2012 to a new peak of $26.3 trillion at the end of 2021, according to … more Report: Aggregate Home Equity Exceeds Record $26 Trillion

Common HECM Questions Posted to FHA’s FAQ Website

The Federal Housing Administration’s Frequently Asked Questions (FAQ) website, a great resource for HECM-related questions, has moved to a new platform that introduces improvements to the search functionality … more Common HECM Questions Posted to FHA’s FAQ Website

A Closer Look at Issues Facing the Appraisal Industry

Reverse Mortgage magazine outlined some of the issues facing the appraisal industry in its March/April 2022 edition, which can be found online at www.nrmlaonline.org/. Here is a closer … more A Closer Look at Issues Facing the Appraisal Industry

AARP: Over Half of Older Americans Happy With Finances

A new survey from AARP finds that just over half of Americans in their 70s (51%) and 80s (52%) rate their financial situation today as excellent or very good. When … more AARP: Over Half of Older Americans Happy With Finances

A Loan Officer’s Guide to Housing Assistance Fund Program

NRMLA has created this informational web page in case you’re contacted by prior clients who need help paying their property taxes and homeowners insurance. Overview The U.S. Treasury … more A Loan Officer’s Guide to Housing Assistance Fund Program

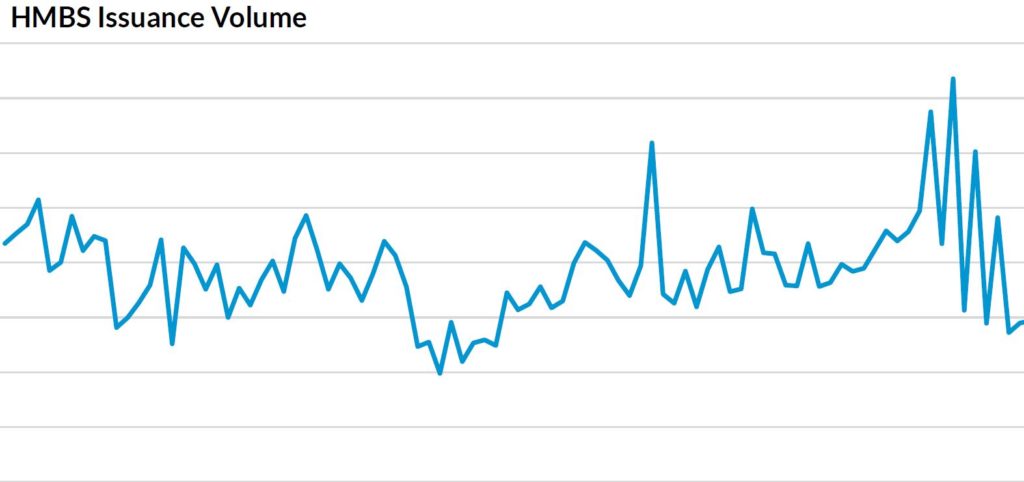

HMBS May 2022: May Flowers Wither; June Gloom Looms

HECM Mortgage-Backed Securities (“HMBS”) issuance fell in May to $1.45 billion, down from April’s record $1.6 billion, as the refinancing wave finally began to ebb. However, production remains … more HMBS May 2022: May Flowers Wither; June Gloom Looms

Compliance Corner: No Fees Prior to Having a Signed Counseling Certificate

HUD’s Office of Housing Counseling contacted NRMLA this week and asked us to remind members that lenders are not permitted to collect a fee or take a final … more Compliance Corner: No Fees Prior to Having a Signed Counseling Certificate

HMBS April 2022 Part II: April May but May June?

HMBS payoffs continued in April, as the refinancing wave diminished slightly but refused to ebb. Instead, April payoffs totaled $1.3 billion, just short of March 2022’s record $1.5 … more HMBS April 2022 Part II: April May but May June?