The U.S. Census Bureau released new statistics from the last census taken in 2020 that revealed the U.S. population 65+ grew nearly five times faster than the total population between … more U.S. Older Population Grew at Fastest Rate in 130 Years

Retirement Issues and Trends

Federal Reserve Issues Economic Well-Being Report

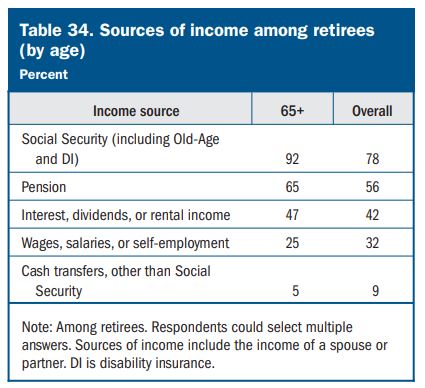

The Federal Reserve Board issued its Economic Well-Being of U.S. Households in 2022 report, which examines the financial lives of U.S. adults and their families. The report draws from the … more Federal Reserve Issues Economic Well-Being Report

Quinnipiac Poll Examines Financial Worries and Raising Retirement Age

In a recent Quinnipiac University national poll of adults, food costs ranked as the most pressing financial worry, with 22 percent of Americans naming it as their biggest personal financial … more Quinnipiac Poll Examines Financial Worries and Raising Retirement Age

Pew: Americans’ Lack of Retirement Savings Could Cost Governments $1.3T

As Americans with insufficient retirement savings leave the workforce over the next 20 years, they will severely strain state and federal budgets, resulting in increased public assistance costs, … more Pew: Americans’ Lack of Retirement Savings Could Cost Governments $1.3T

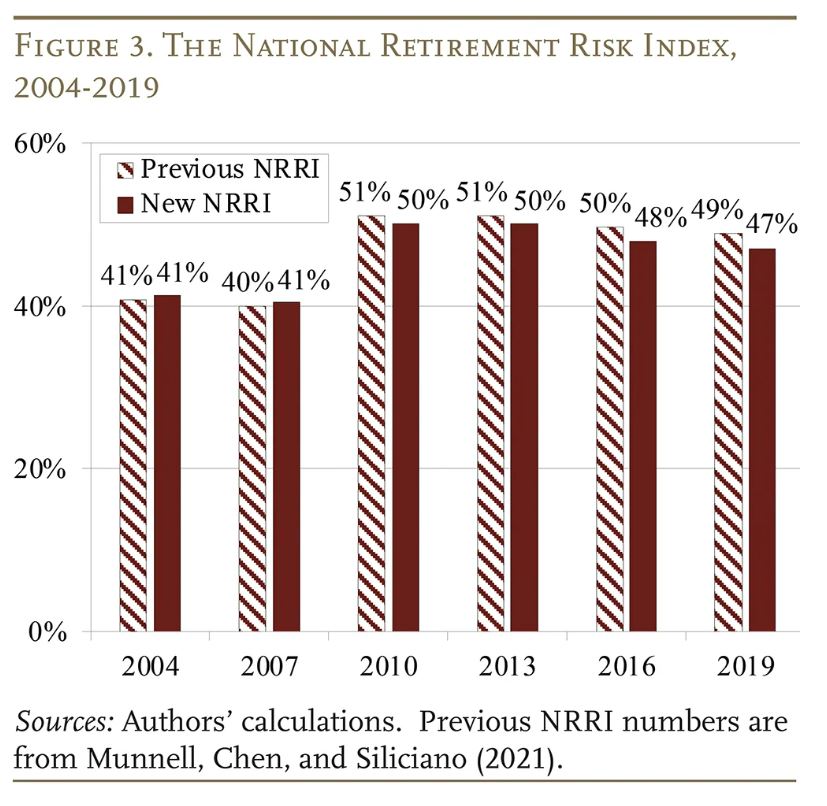

National Retirement Risk Index: Version 2.0

The Center for Retirement Research at Boston College announced that it has modernized its National Retirement Risk Index which measures and analyzes the share of working-age households that … more National Retirement Risk Index: Version 2.0

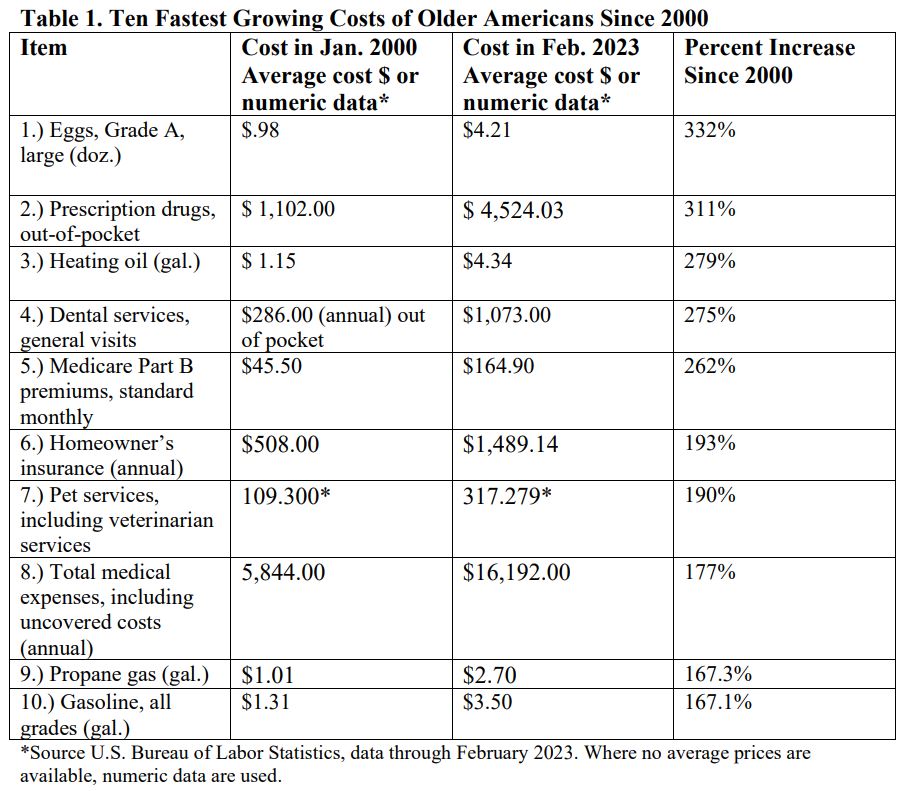

Social Security Benefits Lose 36 Percent Of Buying Power Since 2000

An analysis of Social Security “cost of living adjustments” (COLAs) compared to the actual costs of goods and services purchased by older Americans found that Social Security benefits … more Social Security Benefits Lose 36 Percent Of Buying Power Since 2000

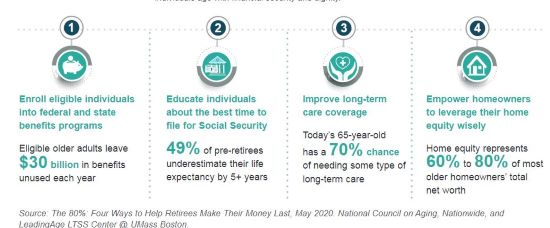

NCOA: 47 Million Older Households Facing Financial Risks

Eighty percent of U.S. households with older adults, or roughly 47 million households, are financially struggling today or are at risk of falling into economic insecurity as they … more NCOA: 47 Million Older Households Facing Financial Risks

401(k) Retirement Accounts Could See Some Big Changes

To help alleviate retirees’ biggest concern that they will run out of money in retirement, two of the world’s largest retirement plan providers, State Street Global Advisors and … more 401(k) Retirement Accounts Could See Some Big Changes

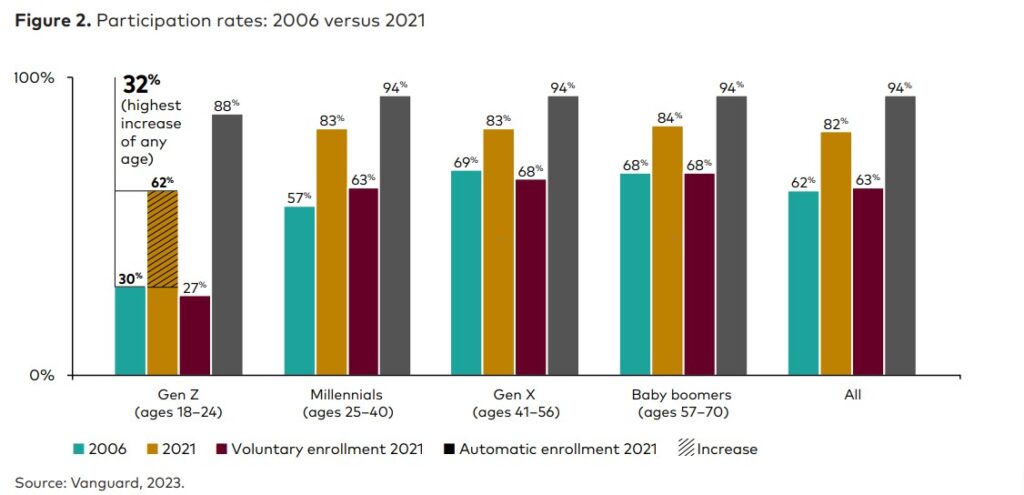

Vanguard Measures Generational Changes in 401(k) Behaviors

The percentage of workers who contributed to workplace 401(k) plans increased between 2006 and 2021 as did the percentage of funds they deferred to their retirement plans, according … more Vanguard Measures Generational Changes in 401(k) Behaviors

Americans Need $1.1M For Retirement, But Few Think They Will Get There

Working Americans ages 45 and older believe it will take $1.1 million in savings to retire comfortably, yet the majority (59 percent) expect to have less than $500,000 … more Americans Need $1.1M For Retirement, But Few Think They Will Get There