A new report from AARP estimated the economic value of family caregivers’ unpaid work in 2021 at $600 billion. This figure was based on about 38 million caregivers … more AARP Highlights Increasing Cost of Family Caregiving

Reference Section

Edelman Appointed Single-Family DAS at FHA

Sarah Edelman has joined the Federal Housing Administration as Deputy Assistant Secretary for Single Family Housing after spending the past five years at Fannie Mae as senior director … more Edelman Appointed Single-Family DAS at FHA

Servicing Corner: Does the 95 Percent Rule Apply to Non-Borrowing Co-Owners?

Weekly Report periodically publishes the “Servicing Corner” to educate readers on the most commonly asked questions that loan officers ask about HECM servicing guidelines. NRMLA received the following … more Servicing Corner: Does the 95 Percent Rule Apply to Non-Borrowing Co-Owners?

‘America’s Retirement Score’ Drops to 78

Fidelity Investments® released its latest Retirement Savings Assessment, which revealed that America’s Retirement Score has moved back into the yellow to 78, a five-point decline from an all-time … more ‘America’s Retirement Score’ Drops to 78

Utah Makes Improvements to Reverse Mortgage Law

Utah Governor Spencer Cox signed legislation (HB 94) into law that lowers the minimum borrower age for proprietary reverse mortgage borrowers from 62 to 55 and changes the … more Utah Makes Improvements to Reverse Mortgage Law

Member Spotlight: Deb Vallow, Cherry Creek Mortgage

To help our members get to know one another, NRMLA will publish periodic Member Spotlights that feature professionals from across the reverse mortgage ecosystem. Meet Deb Vallow, a … more Member Spotlight: Deb Vallow, Cherry Creek Mortgage

White House Budget Forecasts Strong HECM Performance

The Biden Administration released appendices to its Fiscal Year 2024 proposed budget this week that predicted strong economic numbers for the Home Equity Conversion Mortgage program for the … more White House Budget Forecasts Strong HECM Performance

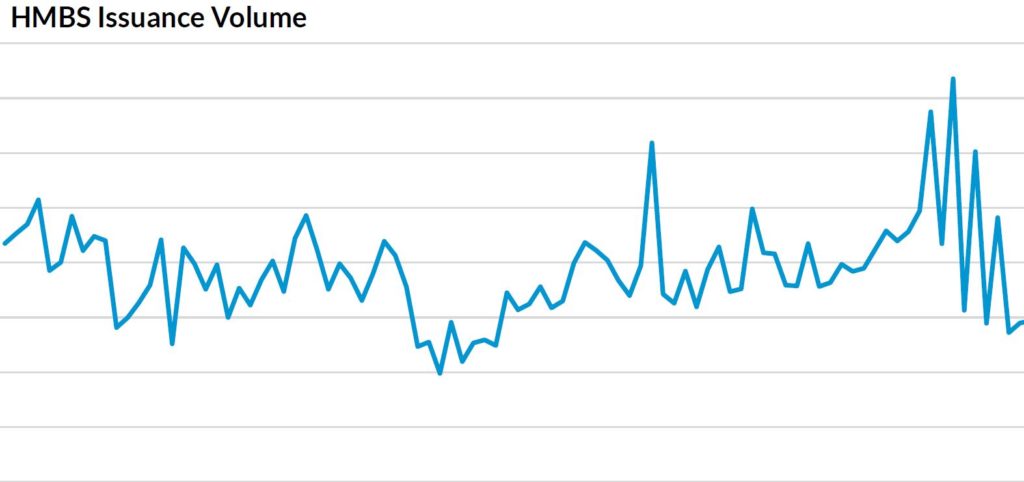

HMBS February 2023 Part II: Waiting For Issuer 43

HMBS payoffs remained low in February, as Mandatory Purchases continued to rise and natural payoffs remained at less than a 7% per annum rate. February payoffs totaled about … more HMBS February 2023 Part II: Waiting For Issuer 43

Member Spotlight: Keith Morgan, CRMP, Mutual of Omaha Mortgage

To help our members get to know one another, NRMLA will publish periodic Member Spotlights that feature professionals from across the reverse mortgage ecosystem. Meet Keith Morgan, CRMP, … more Member Spotlight: Keith Morgan, CRMP, Mutual of Omaha Mortgage

Census: Disasters Displaced More Than 640K Older Americans in 2022

An estimated 3.4 million adults, including 646,443 individuals aged 65 and older, were forced to evacuate their homes in the past year because of a natural disaster, according … more Census: Disasters Displaced More Than 640K Older Americans in 2022